Private Real Estate Investors: The Complete Guide to Building Wealth Through Private Property Investments

Private real estate investors play a vital role in the global property market by funding, acquiring, and managing real estate assets outside of public stock exchanges. Unlike publicly traded REITs, private real estate investments offer greater control, customization, and potential returns for investors who understand the market.

As investors increasingly seek alternatives to volatile public markets, are gaining attention for their ability to generate stable income, long-term appreciation, and portfolio diversification. This guide explains who private real estate investors are, how they operate, the benefits they receive, the real-world platforms they use, and how individuals can participate in private real estate investing.

Who Are Private Real Estate Investors?

Definition and Role in the Real Estate Market

Private real estate investors are individuals, groups, or private firms that invest directly in real estate assets rather than through publicly traded securities. These investors use personal capital, pooled funds, or private partnerships to acquire residential, commercial, or mixed-use properties.

They operate across a wide range of strategies, including rental properties, value-add renovations, development projects, and private lending. Because they are not subject to public market regulations, enjoy flexibility in deal structure and execution.

How Private Real Estate Investors Differ from Public Investors

Unlike public REIT investors who buy shares on stock exchanges, own physical assets, or equity stakes in private entities. This ownership provides direct exposure to property performance rather than stock market sentiment.

Private investments also allow investors to negotiate terms, influence management decisions, and target niche opportunities unavailable in public markets.

Why Private Real Estate Investing Is Growing Rapidly

Demand for Stable Income and Inflation Protection

Private real estate investors benefit from consistent rental income and long-term appreciation. Real estate rents often increase over time, providing a natural hedge against inflation.

As inflation erodes purchasing power, tangible assets like property become more attractive compared to cash or fixed-income investments.

Reduced Volatility Compared to Public Markets

Private real estate investments are not subject to daily market fluctuations. Asset values are driven by fundamentals such as location, demand, and cash flow rather than investor sentiment.

This stability appeals to investors seeking predictable returns and lower portfolio volatility.

Types of Private Real Estate Investment Strategies

Direct Property Ownership

Many private real estate investors purchase properties outright and manage them independently or through property managers. This strategy provides maximum control and long-term upside.

Investors can optimize rents, improve properties, and time sales strategically.

Private Real Estate Syndications

In syndications, multiple investors pool capital to invest in larger properties. A sponsor manages the project while investors receive passive income and profit shares.

This approach allows access to larger deals without full operational responsibility.

Technology Benefits for Private Real Estate Investors

Online Investment Platforms and Market Access

Technology has transformed private real estate investing by providing access to deals through online platforms. Investors can review opportunities, analyze projections, and invest digitally.

This democratizes access to private real estate deals that were once limited to institutional investors.

Advanced Analytics and Portfolio Management

Data analytics tools help private real estate investors evaluate market trends, forecast cash flow, and manage portfolios efficiently. Real-time reporting improves transparency and decision-making.

Remote management tools also support international investing.

Real-World Platforms Used by Private Real Estate Investors

Fundrise

Fundrise is one of the most popular platforms for private real estate investors seeking diversified exposure. It allows investors to participate in private real estate portfolios with relatively low minimum investments.

Fundrise focuses on long-term growth through residential and mixed-use developments.

Use Case: Ideal for investors seeking passive private real estate exposure.

Why Use It: Low entry barrier and diversified portfolios.

RealtyMogul

RealtyMogul connects private real estate investors with institutional-grade commercial and residential deals. The platform offers both individual property investments and diversified funds.

Investors benefit from professional underwriting and asset management.

Use Case: Suitable for experienced investors seeking higher-value deals.

Why Use It: Access to commercial real estate opportunities.

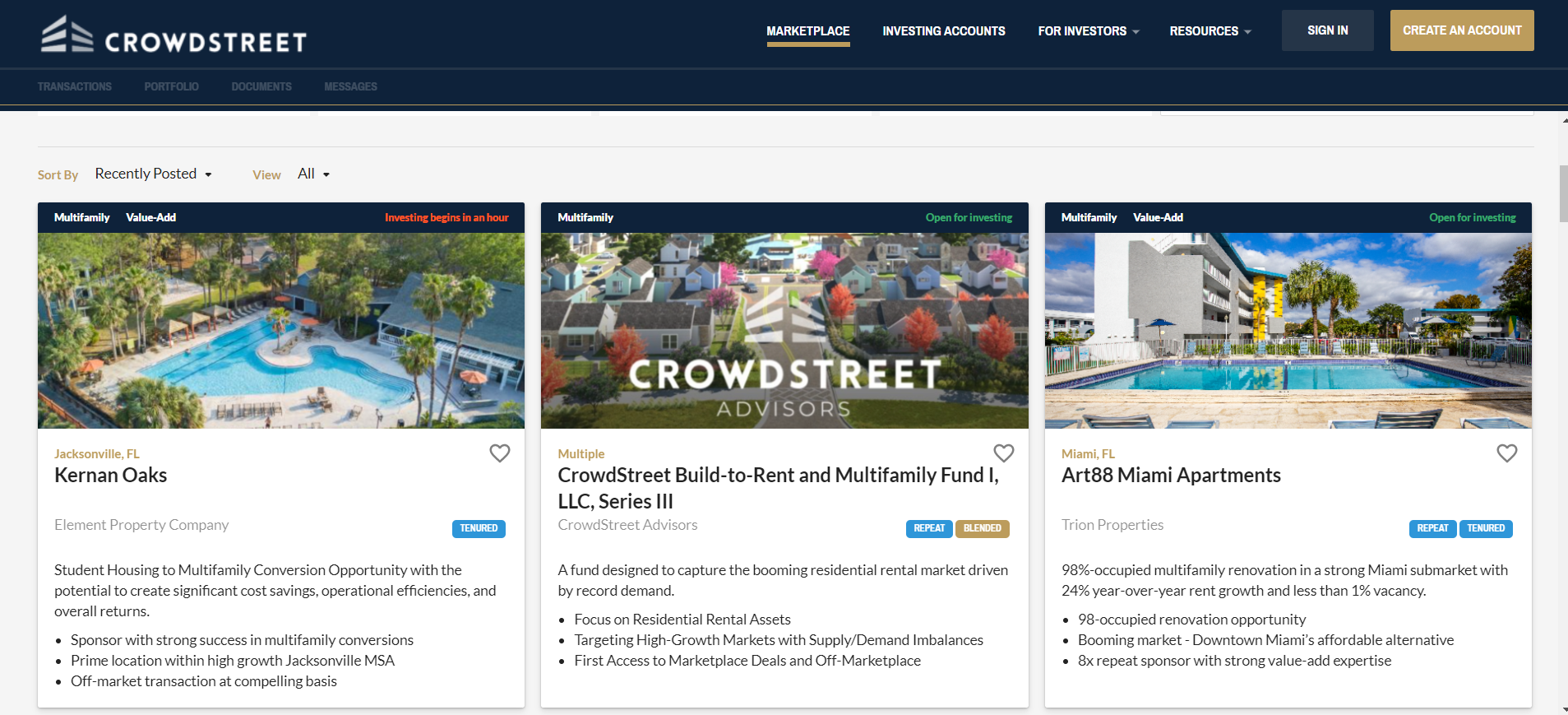

CrowdStreet

CrowdStreet focuses on commercial real estate investments for accredited private real estate investors. The platform emphasizes transparency and direct sponsor relationships.

Investors can choose specific projects aligned with their strategies.

Use Case: Best for investors seeking direct deal selection.

Why Use It: Sponsor-led deals and in-depth analysis.

Yieldstreet Real Estate

:fill(white):max_bytes(150000):strip_icc():format(webp)/Yieldstreet-logo-6681c1f5f3a6450282a2b203441f00ee.jpg)

Yieldstreet offers alternative investments, including private real estate debt and equity. The platform emphasizes income-generating opportunities with defined timelines.

Private real estate investors use Yieldstreet for diversification beyond equity ownership.

Use Case: Ideal for investors seeking income-focused real estate exposure.

Why Use It: Access to real estate-backed investments.

Problems Private Real Estate Investors Solve

Limited Access to High-Quality Assets

Private real estate investors unlock access to off-market and institutional-grade properties that are not available to public investors.

This creates opportunities for higher returns and strategic positioning.

Portfolio Overexposure to Public Markets

By investing privately, investors reduce dependence on stocks and bonds. Real estate provides diversification and income stability.

This helps protect portfolios during market downturns.

Who Should Become a Private Real Estate Investor?

High-Income and Accredited Investors

Private real estate investing is well-suited for investors seeking tax advantages, income, and diversification.

Long-Term Wealth Builders

Those focused on steady growth and capital preservation benefit from private real estate exposure.

Investors Seeking Control or Passive Income

Private real estate offers both hands-on ownership and passive investment options.

How to Start Investing as a Private Real Estate Investor

Define Investment Goals and Risk Tolerance

Determine whether income, appreciation, or diversification is the primary objective.

Choose the Right Platform or Strategy

Select direct ownership, syndications, or online platforms based on experience and capital.

Perform Due Diligence

Review sponsor track records, market fundamentals, and legal structures.

How and Where to Invest with Private Real Estate Investors

Private real estate investments can be accessed through online platforms, private partnerships, and direct acquisitions. Many platforms allow digital onboarding and investment management.

To invest successfully:

-

Compare multiple platforms

-

Review fee structures and timelines

-

Diversify across properties and markets.

Frequently Asked Questions

Q1: Are private real estate investors profitable?

Yes, private real estate investors can generate consistent income and long-term appreciation when investing in quality assets.

Q2: Is private real estate investing risky?

All investments carry risk, but private real estate offers lower volatility than public markets when properly diversified.

Q3: Can beginners invest in private real estate?

Beginners can start through online platforms that offer professionally managed private real estate investments.