Invest in the Best Private REITs for Passive Income and Portfolio Stability

Private REITs, also known as non-traded real estate investment trusts, allow investors to gain exposure to professionally managed real estate portfolios without buying or managing properties directly. Unlike publicly traded REITs, private REITs are not listed on stock exchanges, which means their valuations are not affected by daily market volatility. This structure makes them attractive to long-term investors focused on income and capital preservation.

When investors search for the best private REITs, they are typically looking for consistent cash flow, asset diversification, and protection against inflation. These REITs invest in income-producing properties such as apartment communities, industrial warehouses, healthcare facilities, and commercial buildings. The goal is to generate predictable rental income while benefiting from long-term real estate appreciation.

Why Investors Prefer the Best Private REITs Over Public Markets

One major reason investors choose private REITs is stability. Public REIT prices fluctuate daily based on stock market sentiment, interest rate changes, and economic news. By contrast, are valued periodically based on property performance, which helps smooth returns and reduce emotional investment decisions.

Another important advantage is access to institutional-grade real estate. Invest in large, professionally managed properties that individual investors typically cannot access on their own. This allows investors to benefit from scale, professional asset management, and long-term leasing strategies without needing millions in capital.

Key Benefits of Investing in the Best Private REITs

One of the primary benefits of investing is consistent income. These REITs generate revenue from rental payments and distribute a significant portion of that income to investors. This makes them especially attractive for retirees or investors seeking dependable cash flow.

Another key benefit is diversification. Real estate behaves differently from stocks and bonds, helping reduce overall portfolio risk. By investing in private REITs, investors gain exposure to tangible assets that can perform well during inflationary periods, as rental income and property values tend to rise over time.

Technology-Driven Advantages in Modern Private REIT Platforms

Technology has transformed how we operate and how investors interact with us. Many of the best private REITs now use digital platforms to provide transparent reporting, real-time updates, and easy access to investment documents. This improves investor confidence and simplifies portfolio management.

On the operational side, technology improves property performance. Smart building systems, data analytics, and digital leasing tools help reduce costs and increase occupancy. These efficiencies directly improve net operating income, which benefits investors through higher and more stable distributions.

Real-World Examples of the Best Private REITs to Invest In

Fundrise eREITs

Fundrise offers a range of private eREITs that invest in residential, industrial, and mixed-use real estate across the United States. The platform is designed to make private real estate accessible to individual investors with relatively low minimum investment requirements.

The benefit of Fundrise eREITs is diversification and ease of use. Investors gain exposure to hundreds of properties while managing their investments entirely online. Fundrise solves the problem of limited access to private real estate by removing high capital and knowledge barriers.

Blackstone Real Estate Income Trust

Blackstone Real Estate Income Trust is one of the largest in the world. It focuses on income-producing properties such as rental housing, industrial logistics, and incarcerated across high-growth markets.

Investing in this REIT provides access to institutional-grade real estate managed by one of the most experienced asset managers globally. This solves the challenge of achieving professional diversification and operational excellence as an individual investor.

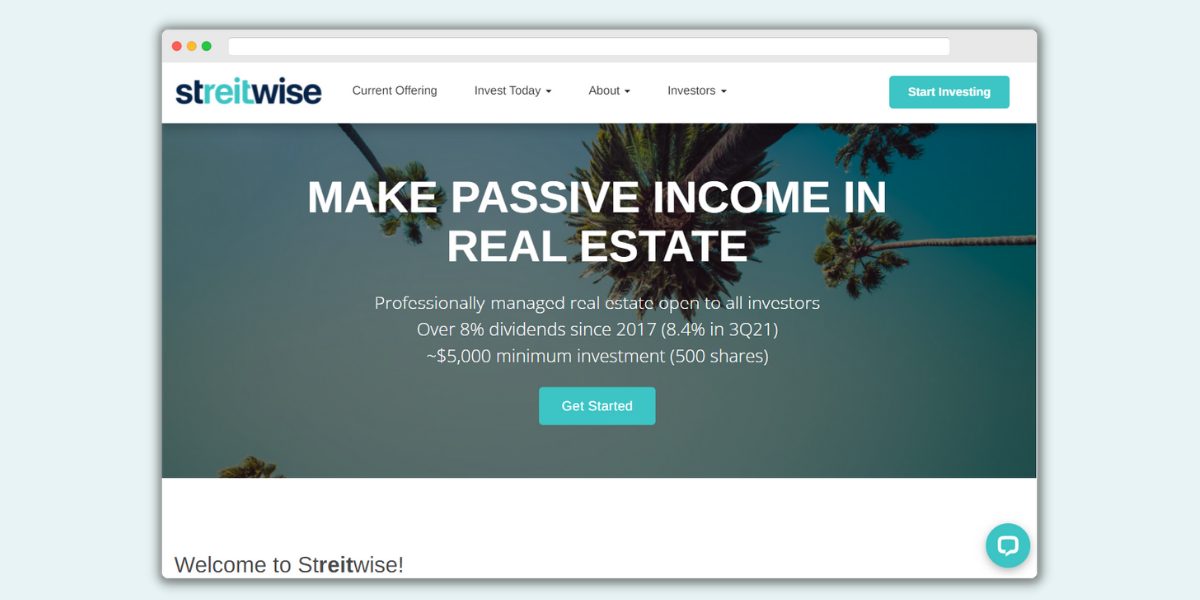

Streitwise Private REIT

Streitwise focuses on income-oriented commercial real estate, particularly office buildings in stable suburban markets. The REIT emphasizes conservative leverage and predictable cash flow.

This private REIT is ideal for investors seeking steady income rather than aggressive growth. It addresses the need for reliability and transparency in private real estate investing, especially for income-focused portfolios.

CrowdStreet Private REITs

CrowdStreet offers access to private REITs and institutional real estate funds sponsored by experienced operators. Their offerings often focus on specific sectors such as multifamily housing, office, and industrial assets.

CrowdStreet solves the problem of limited due diligence by providing detailed investment materials, sponsor backgrounds, and financial projections. This empowers investors to make informed decisions about private real estate exposure.

Use Cases: Problems the Best Private REITs Solve

One major problem private REITs solve is income unpredictability. Traditional stock dividends can be inconsistent, especially during economic downturns. Generate income from long-term leases, providing a more reliable cash flow stream.

Another use case is risk reduction. Investors heavily exposed to equities may experience high volatility. Adding introduces a non-correlated asset class that helps stabilize portfolio performance and reduce downside risk.

Why Investors Need to Invest in the Best Private REITs

Investors need the best private REITs because real estate remains one of the most effective tools for wealth preservation and income generation. Offer exposure to essential property sectors such as housing, logistics, and healthcare, which maintain demand regardless of economic conditions.

Additionally, provide professional management and economies of scale. Investors benefit from experienced teams that optimize property performance, manage risk, and adapt to market changes. This makes a powerful long-term investment vehicle.

How and Where to Buy the Best Private REITs

To invest in private REITs, investors typically open accounts on specialized real estate investment platforms or work with licensed financial advisors. Each platform has its own eligibility requirements, minimum investments, and liquidity terms.

Investors should review offering documents carefully and choose REITs aligned with their income goals, risk tolerance, and investment horizon.

Frequently Asked Questions

Q1: What are private REITs?

Real estate investment trusts that are not publicly traded and focus on income-producing properties are managed by professional teams.

Q2: Are private REITs good for passive income?

Yes, the best private REITs are designed to generate consistent rental income and distribute dividends regularly to investors.

Q3: Who should invest in private REITs?

Are suitable for long-term investors seeking income, diversification, and reduced exposure to stock market volatility.