Investing in Luxury Real Estate Opportunities for Long-Term Wealth and Prestige

Investing in luxury real estate has evolved from being a niche strategy for ultra-high-net-worth individuals into a sophisticated investment class accessible through professional platforms, global developers, and curated property marketplaces. High-end properties offer more than just aesthetic appeal; they provide stability, wealth preservation, and strong appreciation potential when selected strategically.

This in-depth guide explores investing in luxury real estate opportunities from every angle. You will learn what defines luxury real estate, why investors are drawn to it, the benefits and risks involved, real-world platforms and products, and how to buy or invest confidently. Whether you are a seasoned investor or entering the premium property market for the first time, this article provides the clarity you need.

Understanding Luxury Real Estate Investment

What Defines Luxury Real Estate

Luxury real estate refers to high-value residential or mixed-use properties distinguished by prime locations, superior construction, architectural design, exclusivity, and premium amenities. These properties are commonly found in global cities, resort destinations, waterfront locations, and prestigious urban neighborhoods.

Unlike standard residential properties, luxury real estate is less sensitive to short-term market fluctuations. Buyers are often driven by lifestyle, long-term value, and global mobility rather than immediate affordability. This makes luxury real estate a resilient asset class during economic uncertainty.

Luxury properties can include penthouses, waterfront villas, branded residences, historic estates, and smart homes with advanced technology integration. Each category attracts a specific investor profile, from income-focused buyers to capital preservation investors.

How Investing in Luxury Real Estate Differs from Traditional Property Investment

Investing in luxury real estate requires a different mindset than conventional property investing. Entry costs are higher, but so are the potential benefits. Luxury properties often generate lower rental yields compared to mid-market properties, but they compensate with stronger appreciation and asset stability.

Another key difference lies in the buyer pool. Luxury real estate attracts international buyers, corporate executives, and high-net-worth individuals. This global demand supports long-term value growth and creates exit opportunities even during regional downturns.

Additionally, luxury real estate transactions involve specialized agents, legal structures, and financing options. Understanding these complexities is essential for successful investing in luxury real estate opportunities.

Why Investors Are Drawn to Luxury Real Estate

Wealth Preservation and Appreciation

One of the primary reasons investors choose luxury real estate is wealth preservation. Premium properties in prime locations tend to appreciate steadily over time. Land scarcity, zoning restrictions, and high demand create a natural barrier to oversupply.

Luxury real estate often outperforms inflation, making it an effective hedge against currency devaluation. Investors seeking to protect capital over generations frequently allocate a portion of their portfolio to high-end property assets.

Appreciation is further enhanced when properties are located in global cities or lifestyle destinations with strong economic fundamentals, tourism, and infrastructure development.

Lifestyle and Income Synergy

Luxury real estate offers a unique combination of lifestyle benefits and investment returns. Owners can enjoy personal use while generating income through short-term or long-term rentals.

This dual-purpose appeal makes investing in luxury real estate opportunities particularly attractive to entrepreneurs, executives, and retirees. Properties can serve as vacation homes, retirement residences, or corporate retreats while maintaining asset value.

Technology-driven property management has also simplified remote ownership, making luxury real estate more accessible to global investors.

Key Benefits of Investing in Luxury Real Estate Opportunities

Strong Demand and Limited Supply

Luxury real estate benefits from a consistent demand base. High-net-worth individuals continue to grow globally, driving interest in premium properties. At the same time, prime land is limited, especially in iconic cities and resort destinations.

This imbalance between supply and demand supports long-term price stability. Investors benefit from reduced volatility compared to speculative property markets.

Limited supply also enhances resale value, making luxury properties easier to exit when market conditions are favorable.

Advanced Technology and Smart Living

Modern luxury real estate integrates advanced technology, including smart home systems, energy-efficient design, and high-level security. These features increase property desirability and future-proof investments.

Technology enhances tenant experience and reduces operational costs. Smart climate control, remote access systems, and integrated property management platforms make luxury properties more efficient and attractive.

For investors, technology-driven luxury homes command premium rental rates and attract discerning tenants.

Real-World Platforms and Products for Luxury Real Estate Investment

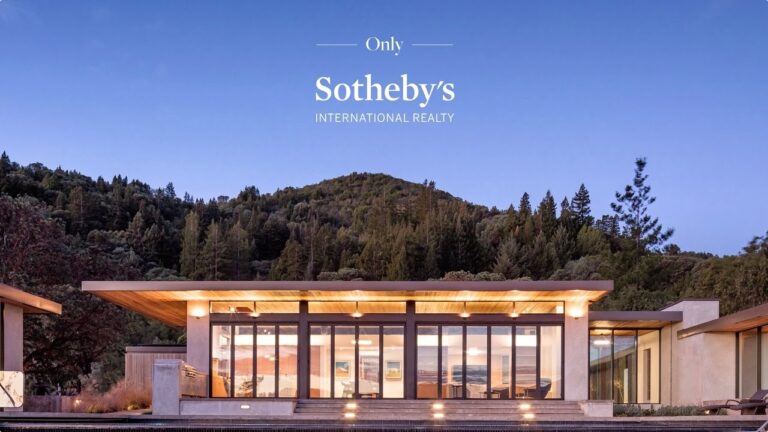

Sotheby’s International Realty

Sotheby’s International Realty is a global leader in luxury real estate brokerage. The platform specializes in exclusive high-end properties across major cities and resort destinations worldwide.

Sotheby’s solves the challenge of accessing premium listings that are often unavailable on mainstream platforms. Its global network connects buyers with vetted luxury properties and expert advisors.

Investors benefit from market insights, brand credibility, and access to rare assets. Sotheby’s is ideal for those seeking direct ownership of iconic luxury properties.

Christie’s International Real Estate

Christie’s International Real Estate focuses on exceptional luxury homes and estates. The platform combines art-world expertise with real estate, emphasizing heritage, design, and exclusivity.

Christie’s addresses the needs of investors seeking culturally significant or architecturally unique properties. These assets often hold value beyond market cycles due to their rarity.

For investors, Christie’s offers access to trophy properties that serve as both investments and legacy assets.

Luxury Presence

Luxury Presence is a technology platform supporting luxury real estate investment through digital marketing and property exposure. While not a brokerage, it empowers luxury agents and developers to reach global buyers.

Luxury Presence solves the problem of visibility in the luxury market. High-end properties require targeted digital strategies to attract qualified buyers.

Investors benefit indirectly by gaining access to well-marketed properties and transparent information, improving decision-making.

Pacaso

Pacaso offers co-ownership of luxury vacation homes. This innovative model allows investors to purchase fractional ownership in premium properties.

Pacaso solves the affordability and utilization problem. Many luxury homes sit vacant for most of the year. Fractional ownership reduces costs while preserving lifestyle benefits.

For investors, Pacaso provides exposure to luxury real estate with lower capital requirements and professional management.

Use Cases: Problems Luxury Real Estate Investment Solves

Portfolio Diversification and Risk Reduction

Luxury real estate provides diversification beyond stocks and bonds. Its performance is driven by different economic factors, reducing overall portfolio risk.

High-net-worth investors use luxury real estate to balance volatile assets. This diversification stabilizes long-term returns and protects wealth during market downturns.

Because luxury properties are tangible assets, they offer psychological and financial security.

Global Mobility and Asset Flexibility

Investing in luxury real estate enables global mobility. Properties in international cities provide access to business hubs, lifestyle destinations, and potential residency benefits.

This use case is particularly relevant for entrepreneurs and global professionals. Luxury properties serve as strategic bases while appreciating.

The flexibility of owning assets in multiple jurisdictions enhances personal and financial freedom.

How to Buy and Invest in Luxury Real Estate Opportunities

Steps to Start Investing

Begin by defining your investment objectives. Decide whether your focus is appreciation, income, lifestyle use, or a combination. This clarity guides property selection and location strategy.

Next, work with specialized luxury real estate advisors or platforms. Conduct thorough due diligence, including market analysis, legal review, and financing options.

Finally, structure ownership efficiently. This may involve trusts, corporate entities, or joint ventures, depending on your goals and jurisdiction.

Why Investing in Luxury Real Estate Opportunities Makes Sense Today

Resilience in Changing Markets

Luxury real estate has proven resilient during economic shifts. While mass-market properties may fluctuate, premium assets retain value due to scarcity and demand.

Investors seeking stability increasingly allocate capital to luxury real estate as a defensive strategy.

This resilience makes luxury property a cornerstone of long-term investment planning.

Long-Term Legacy and Wealth Transfer

Luxury real estate is often passed down through generations. It serves as a tangible legacy asset that maintains value over time.

Families and investors use luxury properties for estate planning, ensuring wealth preservation and continuity.

This long-term perspective reinforces the appeal of investing in luxury real estate opportunities.

Frequently Asked Questions

Q1: Is investing in luxury real estate only for the wealthy?

While traditional luxury real estate requires significant capital, new models like co-ownership and investment platforms have made it more accessible. Investors can now participate with lower entry points.

Q2: Does luxury real estate generate rental income?

Yes, luxury properties can generate high rental income, especially in prime locations. Short-term rentals and corporate leasing often command premium rates.

Q3: What are the risks of investing in luxury real estate?

Risks include higher acquisition costs, longer selling timelines, and market-specific fluctuations. These risks can be managed through careful location selection and professional guidance.

Conclusion

Investing in luxury real estate opportunities offers a powerful combination of wealth preservation, appreciation, and lifestyle benefits. With the right strategy, platforms, and professional support, luxury real estate can become a cornerstone of a resilient and prestigious investment portfolio.