Rent to Own Homes – Complete Guide to Leasing with a Path to Ownership

Rent-to-own homes are residential properties that allow tenants to rent the home with the option to purchase it at a later date. This arrangement provides a pathway to homeownership for individuals who may not currently qualify for traditional mortgages. Typically, a portion of the monthly rent is credited toward the down payment, making it easier to save while living in the home.

Rent-to-own homes are beneficial for both tenants and sellers. Buyers gain time to improve credit scores and financial stability, while sellers can attract tenants committed to purchasing. This option is especially popular in markets with high home prices or for first-time homebuyers.

Benefits of Rent-to-Own Homes

Rent-to-own homes offer several advantages compared to traditional renting or immediate home purchases:

-

Build Equity While Renting: A portion of the monthly rent goes toward the purchase price, helping tenants accumulate equity gradually.

-

Time to Improve Credit: Renters can improve credit scores before securing a mortgage, increasing approval chances and loan terms.

-

Flexibility: Rent-to-own agreements often include flexible purchase timelines, allowing buyers to plan finances effectively.

-

Test Living in the Home: Tenants can experience living in the property and neighborhood before committing to purchase.

-

Lower Upfront Costs: Unlike traditional home buying, rent-to-own typically requires a smaller initial deposit compared to a full down payment.

How Rent-to-Own Homes Work

Rent-to-own agreements generally have two key components: the rental agreement and the option to purchase. Tenants pay rent, usually slightly higher than market rates, with a predetermined portion credited toward the home’s purchase price. A separate option fee is often paid upfront to secure the right to purchase in the future.

The purchase price can be set at the start of the lease or determined at the end of the rental period. These arrangements usually last between 1 to 3 years, providing enough time for buyers to save for a mortgage, repair credit, or secure financing. Rent-to-own contracts protect both parties by outlining terms, purchase price, and responsibilities for maintenance.

Top Rent to Own Home Providers

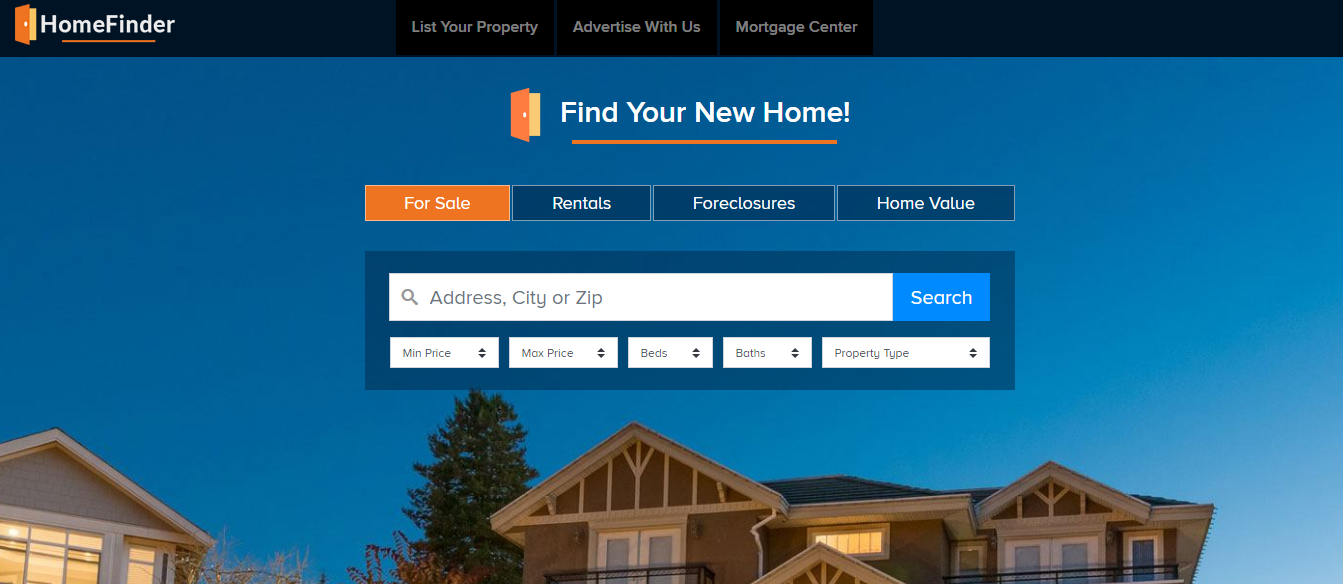

HomeFinder.com

HomeFinder.com offers a wide range of rent-to-own homes across the United States. The platform allows users to filter by price, location, and property type, making it easy to find suitable homes.

The benefit of HomeFinder is its extensive database, which provides detailed property descriptions, photos, and options for contacting sellers directly. Renters can easily compare homes and select the best option for their budget and timeline.

RentUntilYouOwn.com

RentUntilYouOwn.com specializes in lease-to-own properties nationwide. The site provides tools for calculating rent credits and tracking how much of the rent goes toward the eventual purchase.

This service helps potential homeowners understand their financial progress and manage expectations. Additionally, RentUntilYouOwn offers guidance on negotiating contracts and understanding legal obligations.

HousingList.com

HousingList.com features thousands of rent-to-own listings, including single-family homes, condos, and townhouses. Users can search by state, city, or ZIP code to find properties tailored to their needs.

HousingList.com makes the rent-to-own process transparent by providing detailed property history, photos, and seller contact information, ensuring buyers make informed decisions.

RentToOwnLabs.com

RentToOwnLabs.com offers an extensive collection of lease-to-own homes with an emphasis on affordable housing solutions. The platform provides resources for understanding contracts, financing, and local housing markets.

The platform is particularly beneficial for first-time buyers who need guidance navigating legal documents and understanding the financial implications of rent to own agreements.

HomeSteps.com

HomeSteps.com is backed by Fannie Mae and provides rent-to-own options for foreclosed homes and affordable housing. Buyers gain access to homes with lower initial investment requirements and potential for future appreciation.

The advantage of HomeSteps is the credibility and reliability of listings, as the properties are managed by a government-backed organization, ensuring legal transparency and fair transactions.

Use Cases and Problem Solving

Rent-to-own homes solve several challenges for prospective homeowners:

-

Credit Improvement: Individuals with low credit scores can rent to own to improve their financial standing while accumulating equity.

-

Down Payment Assistance: Rent credits and smaller initial deposits allow renters to save for the full down payment over time.

-

Flexibility for Job Relocation: Rent-to-own contracts provide time to test neighborhoods before committing to a permanent purchase.

-

Alternative to Traditional Mortgages: Rent-to-own offers a solution for those who cannot qualify for conventional loans due to income or credit constraints.

Rent-to-own homes are particularly helpful in areas with rising real estate prices, where immediate purchase is financially challenging. This approach allows prospective homeowners to plan long-term while still living in the home they intend to buy.

Frequently Asked Questions

Q1. Can I negotiate the purchase price in a rent-to-own agreement?

Yes, the purchase price is often negotiable before signing the agreement. Buyers should consider market conditions and seek advice from a real estate professional.

Q2. What happens if I can’t buy the home at the end of the lease?

If the buyer cannot purchase, the option fee and rent credits may be forfeited, depending on the contract. Always review terms carefully.

Q3. Are rent-to-own homes a good investment?

Yes, especially for first-time buyers who need time to improve their credit or save for a down payment. It allows building equity while living in the home.